close

Choose Your Site

Global

Social Media

Views: 0 Author: Site Editor Publish Time: 2026-01-19 Origin: Site

The global paper industry is on a rapid growth trajectory, impacting sectors like packaging, hygiene, and commercial printing. As the industry adapts to increasing consumer demand for sustainable materials, it’s expected to reach USD 351.7 billion by 2025.

In this article, we’ll explore key statistics and growth projections for the paper market heading into 2026. You'll discover how trends like eco-friendly production methods and automation are reshaping the industry and what it means for businesses.

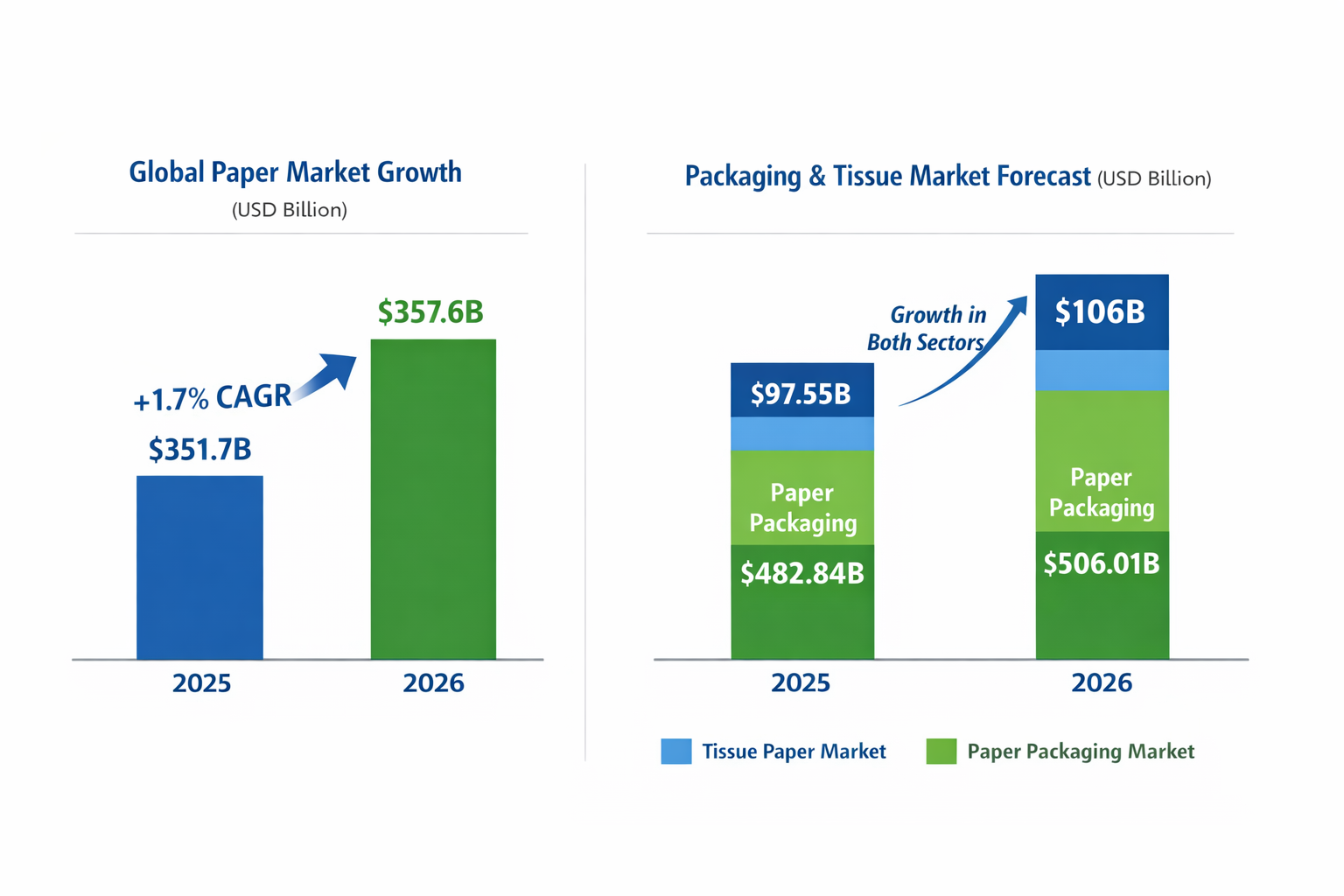

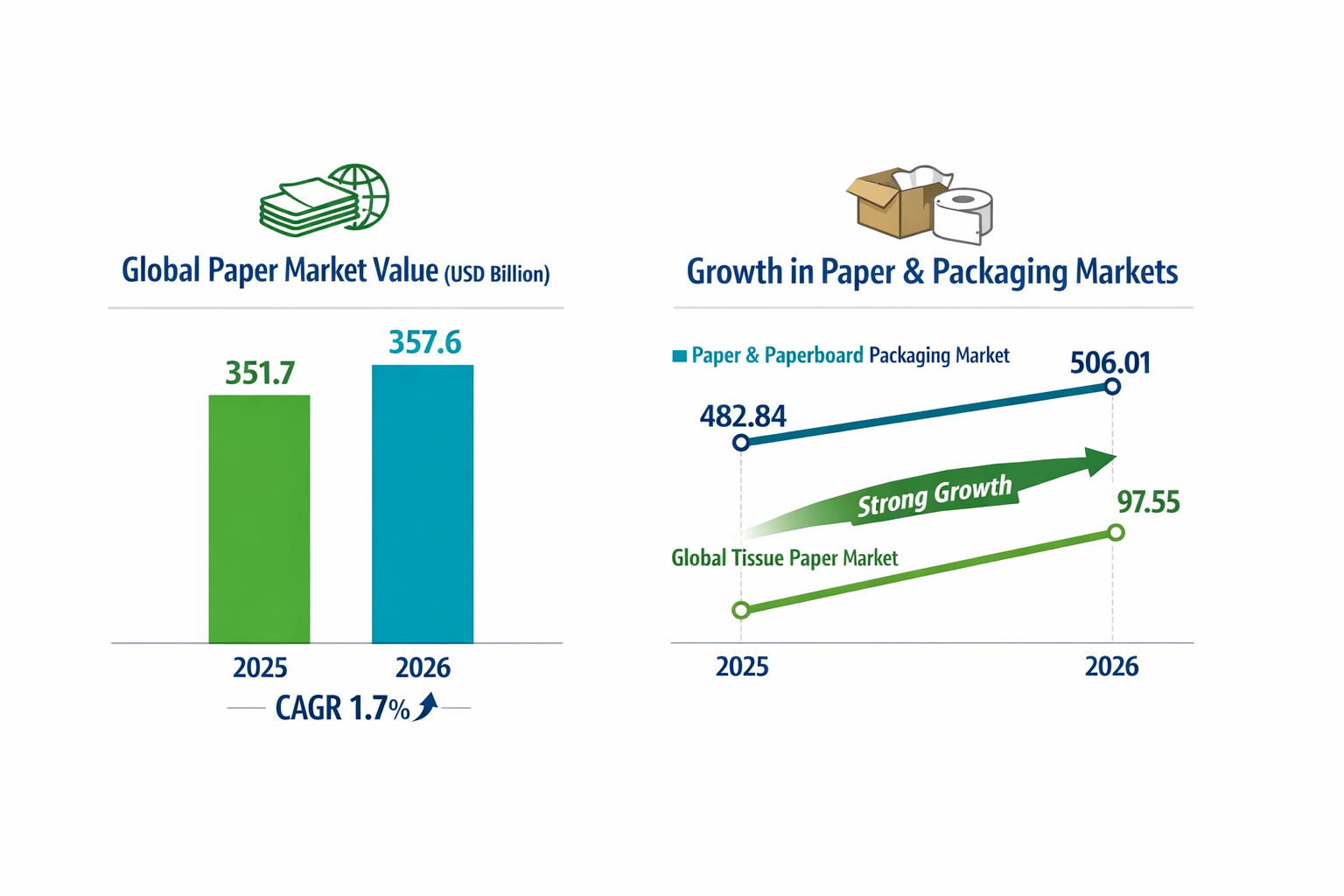

In 2025, the global pulp and paper market is expected to reach a valuation of USD 351.7 billion, and by 2026, this figure is projected to grow to USD 357.6 billion, marking a steady growth trajectory driven by global consumption and production of paper products. The market is anticipated to maintain a Compound Annual Growth Rate (CAGR) of approximately 1.7% from 2025 to 2026. This growth will be propelled by several key sectors, including packaging paper and tissue paper.

● Asia-Pacific is expected to continue leading both production and consumption, driven largely by China, India, and Japan.

● North America and Europe, while still major players in the global market, will experience a more moderate growth rate compared to emerging markets.

One of the primary factors fueling this growth is the increase in consumer demand for sustainable packaging solutions and hygiene products. The rise in e-commerce, particularly during the pandemic, has had a lasting effect on packaging paper consumption, and tissue paper products, such as napkins and facial tissues, are forecasted to see steady demand growth in both residential and commercial settings.

Production in China will continue to dominate global paper output, contributing significantly to the global supply. The United States and Germany remain pivotal in paper production, but their growth is hampered by the increasing digitalization of media and consumer habits shifting away from traditional paper-based products. The tissue paper market, however, is expected to see robust growth, with products like napkins, toilet paper, and facial tissues driving demand.

In terms of consumption, packaging paper continues to be the largest segment globally, driven by the growth of e-commerce and the increasing preference for sustainable packaging. Meanwhile, hygiene paper products, such as facial tissue raw materials, kitchen towel paper raw materials, and paper towel raw materials, will also see significant growth as consumers demand more hygienic and eco-friendly products.

The paper industry in 2025 will be shaped by several key trends, notably the increasing focus on sustainability, digital transformation, and regional market shifts.

● Sustainability: As environmental concerns rise, there will be a marked shift toward more recycled paper and biodegradable materials in production. This trend is driven by both consumer demand for eco-friendly products and stricter environmental regulations that require paper manufacturers to reduce waste and use more sustainable materials.

● Innovation in Raw Materials: Paper products like napkin paper raw materials and facial tissue raw materials will increasingly incorporate recycled fibers, driven by both sustainability concerns and consumer demand for greener alternatives. Companies focusing on these innovations will lead the market in terms of production efficiency and eco-friendly practices.

● Digitalization: While the digital world is a threat to traditional printing paper, it creates new opportunities in other paper product segments such as packaging and tissues. As e-commerce continues to grow, the need for packaging paper will rise significantly, and manufacturers are increasingly turning to automated processes to meet growing demand and improve cost-efficiency.

Looking ahead to 2026, the global paper production industry is forecasted to continue growing, supported strongly by rising demand for sustainable products and the ongoing shift toward eco‑friendly packaging solutions. According to market forecasts, the global paper and paperboard packaging market is expected to increase from an estimated USD 482.84 billion in 2025 to approximately USD 506.01 billion in 2026, reflecting a steady demand growth in packaging grades driven by e‑commerce and sustainability trends.

In the tissue paper segment, global demand is also projected to expand significantly as consumer focus on hygiene and convenience continues to rise. For example, the global tissue paper market size is estimated at USD 97.55 billion in 2025 and overall trends through the 2025–2034 period imply sustained double‑digit annual growth trends, underscoring strong demand for products like napkin paper and facial tissues.

Packaging Paper: The rapid expansion of online shopping and logistics continues to push demand for sustainable packaging paper, especially paperboard and corrugated paper used in shipping and e‑commerce. This trend will be a key growth driver in 2026 as brands prioritize recyclable and renewable materials over plastics.

Tissue Paper: At the same time, tissue products such as napkin paper and facial tissues are expected to maintain strong demand due to lasting hygiene awareness post‑pandemic and rising disposable incomes in emerging markets, further supporting growth across this segment.

The impact of digital transformation on the paper industry will continue in 2026. The industry is increasingly adopting automation and artificial intelligence (AI) to streamline production processes, reduce waste, and enhance efficiency. These technological advancements will help paper manufacturers minimize production costs while improving product quality and consistency.

Automation, particularly in tissue and packaging paper production, will enable companies to meet demand surges while controlling labor costs. The use of smart sensors and predictive maintenance systems will also reduce downtime, improving overall efficiency.

Sustainability continues to shape the outlook for paper demand through 2026. As consumers and regulators push for greener materials, the preference for recycled paper products and eco‑friendly packaging materials is strengthening. According to market research, paper packaging markets are expected to sustain CAGR levels near 4.6% between 2026 and 2031, driven partially by environmental regulations and consumer shifts toward recyclable substrates.

The adoption of circular economy principles is expected to accelerate innovation in paper recycling, requiring more sustainable inputs such as recycled fiber, which in turn influences upstream requirements like facial tissue raw materials and kitchen towel paper raw materials that emphasize eco‑credentials.

In North America and Europe, the market for traditional graphic paper grades will continue to decline due to digital substitution, but packaging and specialty paper segments remain stable. Regional sustainability policies and environmental mandates are encouraging the use of recycled materials and renewable source fibers, resulting in moderate but steady growth for recyclable and biodegradable paper products.

North America, in particular, remains a strong region for specialty and packaging grades, though growth rates are not as high as in emerging markets. Efforts to reduce carbon footprints and comply with regulatory standards are key priorities for manufacturers facing increasing environmental scrutiny.

Asia‑Pacific is forecasted to remain the largest and fastest‑growing regional market for paper products in 2026 due to rapid industrialization, increases in consumer demand, strong e‑commerce adoption, and urbanization trends, with China, India, and Japan leading production and consumption. In this region, demand for paper towels, napkin paper, and facial tissue raw materials is expected to rise sharply as rising living standards and hygiene awareness transform local markets.

Emerging markets in Latin America and Africa are poised for moderate growth, supported by increasing consumer incomes and improving infrastructure. Brazil and Mexico, for example, are seen as key growth hubs for tissue and hygiene products, though supply chain limitations and regulatory variability may temper expansion speed. In Africa, rising hygiene awareness and expanding retail networks will contribute to rising demand for paper‑based consumer products.

The paper industry faces increasing pressure to comply with environmental regulations in North America and Europe. These regulations encourage the use of recycled content in paper products and mandate more sustainable production practices. Companies that fail to meet these requirements may face penalties or lose consumer trust. As a result, paper manufacturers will need to invest in greener technologies and improve sustainability metrics across their supply chains.

Innovation is key to staying competitive in the eco-conscious marketplace. Manufacturers are focusing on biodegradable and recyclable paper products to meet growing consumer and regulatory demands. Notable innovations include the development of chlorine-free paper and enhanced paper recycling technologies, which will help paper manufacturers meet the rising demand for sustainable products.

AI and automation are transforming the paper industry. From predictive maintenance to supply chain management, AI is improving operational efficiency. Automation allows companies to meet rising demand while reducing labor costs and minimizing waste. The smart paper factory is a key concept for the future of paper production, enabling manufacturers to produce higher-quality products at a lower cost.

Innovations in paper recycling processes are essential for improving fiber recovery rates and reducing waste. The development of advanced deinking technologies allows manufacturers to recycle paper more efficiently, reducing the need for virgin materials. The rise of the circular economy will help make recycling more effective and economically viable for the paper industry.

Sustainable packaging is one of the largest growth segments within the paper industry. According to forecasts, the global paper and paperboard packaging market will continue its expansion from USD 482.84 billion in 2025 to USD 506.01 billion in 2026, benefiting from robust demand driven by e‑commerce and consumer preference for biodegradable materials.

With plastics under increasing environmental scrutiny, paper packaging alternatives such as corrugated board, molded pulp, and fiber‑based cartons are gaining adoption across consumer goods, food and beverage, and industrial logistics sectors.

Tissue products including napkins, facial tissues, and paper towels will continue to show strong demand growth in 2026. With global hygiene awareness elevated after recent health events, tissue paper remains a resilient segment, with long‑term forecasts showing a market expansion from USD 97.55 billion in 2025 to significantly larger figures over the decade.

The paper industry is undergoing significant transformations, driven by changing consumer behaviors, technological innovations, and increasing demand for sustainable products. As a leading manufacturer of large-roll tissue paper, Huaxin Global is at the forefront of these changes, providing high-quality products like Napkin Paper Raw Materials, Facial Tissue Raw Materials, Kitchen Towel Paper Raw Materials, and Paper Towel Raw Materials. The forecast for 2025 and 2026 indicates steady growth in key sectors such as packaging paper, tissue products, and recycled paper. Companies like Huaxin Global, which focus on sustainable and innovative solutions, will be well-positioned to thrive in this dynamic market. By embracing green technologies and adapting to changing regulations, Huaxin Global is committed to meeting the growing demand for eco-friendly and high-performance tissue paper materials.

For businesses looking to stay competitive, strategic planning is essential, and Huaxin Global offers the perfect partnership in this journey. With a focus on quality and sustainability, our products can help you stay ahead of market trends. Reach out today to explore how Huaxin Global can fulfill your tissue paper raw material needs and help your company lead the way in a sustainable future.

A: The paper industry is forecasted to grow to USD 357.6 billion by 2026, with a steady Compound Annual Growth Rate (CAGR) of 1.7%, driven by increased demand for sustainable products.

A: Sustainability, digitalization, and innovation in raw materials, such as Napkin Paper Raw Materials and Facial Tissue Raw Materials, are expected to shape the paper industry through 2026.

A: Automation and AI are transforming production processes in the paper industry, improving efficiency and reducing waste, while also enabling companies to meet the rising demand for Kitchen Towel Paper Raw Materials.

A: Investing in recycled paper products is key for companies looking to meet sustainability goals, reduce costs, and comply with environmental regulations, with Paper Towel Raw Materials being a prime example of this shift.

A: Stricter environmental regulations are pushing paper manufacturers to adopt sustainable practices, such as using recycled fibers in products like Napkin Paper Raw Materials, to reduce environmental footprints.